If you’re searching for the best instant loan app in India that doesn’t require a salary slip, you have several options.

Sometimes, you need quick access to funds for personal needs, but traditional banks and financial institutions can be time-consuming.

In such situations, certain apps offered by RBI-registered NBFCs (Non-Banking Financial Companies) come to the rescue, providing hassle-free short-term Instant loans without the need for salary slips.

Contents

- 1 Best Instant Loan App Without Salary Slip

- 2 5 Best Instant Loan Apps without Salary Slips in India

- 2.1 Kreditbee Instant Loan App Without Salary Slip

- 2.2 Nira Personal Loan

- 2.3 InCred Finance

- 2.4 True Balance Personal Loan

- 2.5 Money View Instant Loan App without Salary Slip

- 2.6 Eligibility Criteria for Instant Loan App without Salary Slip in India

- 2.7 FAQs Related to Best Instant Loan App in India Without Salary Slip

- 2.8 How can I Get an Instant Loan without a Salary Slip?

- 2.9 How to get an instant loan of Rs 50,000 without a salary slip?

- 2.10 How to get a loan of Rs 2 lakh without a salary slip?

- 2.11 Related

Best Instant Loan App Without Salary Slip

| Article Topic | Best Instant Loan App in India Without Salary Slip |

| Interest Rate | Competitive Interest rate starting from 15% per annum. |

| Loan Amount | Rs 1,000 to Rs 50,000 |

| Tenure | 62 days to 24 months |

| Application Process | 100% digital Process (Online) |

| Collateral | No Collateral required |

| Age | The minimum age required is 21 years. |

Features and Benefits of Instant Loan app without documents

There are some essentials to be aware of the risks and drawbacks associated with these apps. Let’s delve into the features, benefits, and charges of an instant loan app that doesn’t require a salary slip.

Advantages of Instant Personal Loans:

Digital Process: NBFCs offering instant loan applications keep the entire process digital. You can apply for a loan online and receive the funds directly in your bank account.

Collateral-Free: Instant personal loans are typically unsecured, meaning you don’t need to provide collateral to avail of them.

Quick Eligibility Check: Applying for a loan is straightforward. Many non-banking financial companies offer an online eligibility check, letting you know within minutes whether you qualify for the loan.

No Salary Slip Required: While most loans require a salary slip, some financial institutions offer instant loans even without one. Instead, you can provide proof of alternative income.

Swift Disbursement: Once you apply for the loan, the funds are swiftly transferred to your bank account via the digital platform.

5 Best Instant Loan Apps without Salary Slips in India

Now I will provide you with some company reviews, which are providing instant loan facilities without salary slips to their customers.

The companies we will mention are not recommendations. You should use your thinking and understanding and apply for the loan only after reading the terms and conditions of the company.

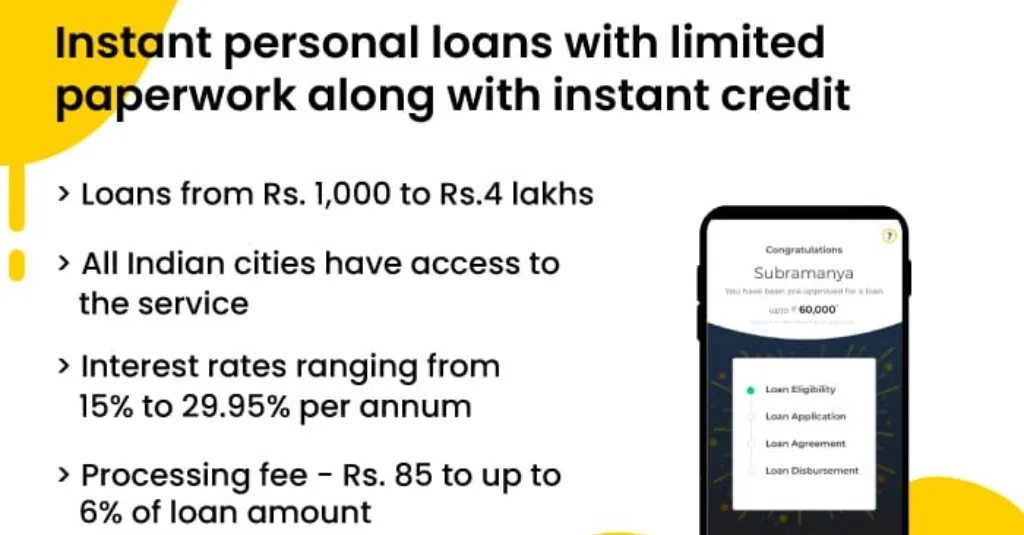

Kreditbee Instant Loan App Without Salary Slip

The Kreditbee application is a good option that can provide you with instant loans without a salary slip. For those who want a personal loan for their needs, Kreditbee offers small credit loans up to Rs 50000 at reasonable interest rates.

If your CIBIL score is below 750, you may have to provide income proof such as your Income Tax Return, Saving Account Statement, etc.

| Loan Amount | Rs 1,000 to 4 lakhs |

| Interest Rate | 15% to 29.95% p.a. |

| Loan Tenure | 62 days to 24 months |

| Processing Fee | Processing fees range from ₹85 to up to 6.5% of the loan amount. |

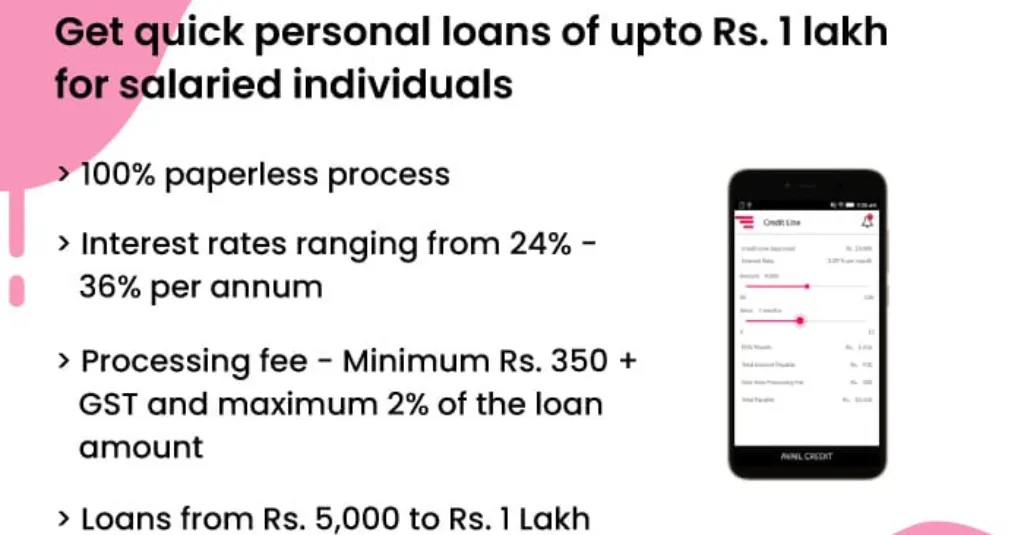

Nira Personal Loan

Nira is an Indian consumer finance business that provides small loans to low-income salaried individuals. You can apply for the loan through the NIRA app and get approved in 3 minutes.

The loan would be similar to a credit card, where there is a pre-determined limit that you can use the loan for any purpose, such as medical emergencies, education, travel, or shopping.

NIRA Personal Loan is an RBI-compliant loan app that operates in more than 5,000 locations across India.

| Loan Amount | Rs 5,000 to Rs 1,00,000 |

| Interest Rate | 24% to 36% per annum. |

| Loan Tenure | 3 to 12 Months |

| Processing fee | On an average 750/- |

InCred Finance

Incred Personal Loan is a loan product offered by Incred Financial Services Limited, a non-banking financial company (NBFC) that offers a variety of loans to individuals and businesses in India. To take a loan up to Rs 50,000, you do not need to provide income proof.

You can apply for an InCred Personal Loan through the InCred app or website and get instant approval and disbursement.

| Loan Amount | Rs 50,000 to 10 Lakhs |

| Interest Rate | 16% to 36% per annum |

| Tenure | 12 to 60 months |

| Processing fee | Minimal 2% to 5% |

True Balance Personal Loan

With True Balance, you can get an instant personal loan of up to Rs 50000 without a salary slip. It is trusted by over 75 million users across the country.

Enjoy a better borrowing experience with you when you apply for a personal loan. The interest rate for a True Balance Personal Loan starts from 2.4% per month and goes up to 3.9% per month depending on your credit score, income, occupation, and other factors.

| Loan Amount | Rs 5,000 to 1,00,000 |

| Interest Rate | 2.4% to 3.9% per month |

| Tenure | 3 to 6 months |

| Processing Fee | 5% to 15% on the loan amount |

Money View Instant Loan App without Salary Slip

Money View is one of the best instant loan apps in India without salary slips because of its quick and easy process, minimal documentation, flexible repayment options, and user-friendly features.

You can apply for a loan amount ranging from Rs 5,000 to Rs 10 lakhs, depending on your eligibility and credit profile. You can also track your loan status and repayment schedule online through the app or website.

| Loan Amount | Rs 5,000 to 10 lakhs |

| Interest Rate | Interest rates starting from 1.33% per month (16% annually) |

| Tenure | Up to 60 months |

| Processing fee | Starting from 2% of the approves loan amount |

Eligibility Criteria for Instant Loan App without Salary Slip in India

- The applicant must be a citizen of India.

- At the time of applying for the loan, the age of the applicant should be between 21 to 57 years.

- To take a loan without a salary slip, the CIBIL score should be 750 and above.

- The Applicants must have a monthly income source.

Documents Required for Instant Loan App without Salary Slip

To avail of an Instant personal loan, you need to provide the necessary documents, but due to a low credit score, some additional documents may be required, which are mentioned below.

- Pan Card

- Aadhar Card Should be linked with a Mobile Number.

- Address Proof: Any one of the documents – Passport, Aadhar Card, Voter ID Card, Driving Licence.

- Identity Proof: Any one of the documents – Passport, PAN Card, Ration Card, Aadhar Card, Voter’s ID Card, Driving Licence.

- Income Proof: Last Six months’ bank statements, Income Tax Returns, etc.

FAQs Related to Best Instant Loan App in India Without Salary Slip

How can I Get an Instant Loan without a Salary Slip?

Taking an Instant loan without a salary slip is a bit difficult but it can be achieved with some lenders but such loans may attract higher interest. If you submit separate income proof instead of a salary slip, then you can easily get the loan.

How to get an instant loan of Rs 50,000 without a salary slip?

To take an Instant loan of Rs 50000 without a salary slip, you will need some other income proof like an income tax return and, the latest bank statement. You can also get an instant personal loan of Rs 50,000 without a salary slip by providing collateral.

How to get a loan of Rs 2 lakh without a salary slip?

InCred Finance provides the facility to its customers that they can get a loan of up to Rs 2 lakh by completing their KYC process without providing any documents, but it is necessary to provide bank details to get this loan.