An RBI approved loan apps developed and operated by a financial institution is registered and regulated by the RBI. This includes banks, non-banking financial companies (NBFCs), and other lending institutions.

An RBI registered loan apps must follow all the rules and guidelines of the RBI for loan disbursement. They must also adhere to guidelines for repayment and recovery.

In today’s article, you will get information about registered apps. These apps offer you instant loans by becoming an RBI approved loan apps in India.

Contents

- 1 “RBI Approved Loan Apps in India” List: Best Loan Apps in India

- 2 Top 10 RBI Approved Loan Apps in India 2023

- 2.1 Features of RBI Approved Loan Apps in India

- 2.2 RBI Approved Loan Apps Interest Rate

- 2.3 RBI Approved Loan Apps Eligibility Criteria

- 2.4 How to apply for a loan on RBI Approved Loan Apps in India?

- 2.5 RBI Approved Loan Apps Related FAQ:

- 2.6 Which loan apps are RBI-approved?

- 2.7 Are online loan apps safe?

The process to get an RBI approved loan apps in India

- The company operating the loan app must obtain a license from the RBI. This license allows it to act as a non-banking financial company (NBFC). This involves submitting an application to the RBI and providing information about the company’s management, financials, and business plan.

- After the license is granted, the company must follow all the regulations the RBI sets for NBFCs. This includes guidelines for digital lending.

- The company must also register the loan app with the RBI. They need to give details about the app’s features. They must give information on data security measures and customer protection policies.

- The RBI will review the registration application. It will conduct an on-site inspection to verify that the loan app complies with its regulations.

- After the registration process is finished, the loan app will be included in the list of registered NBFCs. This list is on the RBI website. It can then run legally in India.

“RBI Approved Loan Apps in India” List: Best Loan Apps in India

| App Name | Credit Limit | (Lowest) Rate of Interest (p.a.) |

| Navi | Loan up to 20 Lakh | 9.90% |

| Money View | 5k to 5 Lakh | 16.00% |

| Kreditbee | 1000 to 3 Lakh | 15.00% |

| CASHe | Up to 4 Lakh | 24.00% |

| Fibe (EarlySalary) | Up to 5 Lakh | 24.00% |

| NIRA Finance | Up to 1 lakh | 24.00% |

| MoneyTap | Up to 5 Lakh | 12.96% |

| PayMe | Up to 2 Lakh | 18.00% |

| Privo | Up to 2 Lakh | 13.49% |

| mPokket | Up to 30k | 24.00% |

| InstaMoney | 5k to 25k | 24.00% |

| True Balance | 5k to 50k | 28.80% |

| PaySense | Up to 5 Lakh | 16.00% |

| IIFL Personal Loan | Up to 5 Lakh | 12.75% |

| Bajaj Finserv | Up to 25 Lakh | 12.99% |

| Faircent | Up to 10 Lakh | 18.00% |

| Home Credit | Up to 5 Lakh | 19.00% |

| LoanTap | 50k to 10 Lakh | 18.00% |

| Finnable | 50k to 10 Lakh | 18.99% |

| IndusInd Bank Personal Loan | 30k to 50 Lakh | 10.49% |

| IIFL Business Loan | 10k to 30 Lakh | 12.75% |

| Kissht | Up to 1 lakh | 14.00% |

| Branch Personal Loan Cash Loan App | Up to 50k | 24.00% |

| Dhani (Credit Line) | Instant Credit Line 50k | 0.00%-42.00% |

| Stashfin | 1k to 5 Lakh | 11.99% |

| SmartCoin | 4k to 1 lakh | 0%-30% |

| Indialends | Up to 25 Lakh | 10.25% |

| India’s Gold Loan | As Per Gold Value | 8.28% |

| Piramal Finance | 10k to 10 Lakh | 11.99% |

| IDFC First Bank (MyFIRST Partner) | 20k to 40 Lakh | 11.00% |

| Rupeek App Gold Loan | As per Gold Value | 7.08% |

| Buddy Loan | Up to 15 Lakh | 11.99% |

| FlexSalary Instant Loan App (Credit Line) | Up to 2 Lakh | 36.00% (lowest) |

| Tata Capital | Up to 35 Lakh | 10.99% |

| Hero FinCorp | Up to 1.5 Lakh | 25.00% (lowest) |

| Prefr | Up to 3 Lakh | 18.00% |

| Kreditzy | Up to 2 Lakh | 0 – 28.80% |

| 12%Club | Up to 1 Lakh | |

| ZestMoney (Credit Line) | 10 to 10 Lakh | 3%-35% |

| Paytm Personal Loan | Loan up to 3 Lakh | 10.5% |

| Aditya Birla Capital | Up to 50 lakhs | 14.00% |

| Creditap (Study Loan) | Up to 15 lakhs | 8.45% |

| Mobikwik (Shopping) | Up to 2 lakhs | 9.00% |

| Avail Finance | 1000 to 40k | 15.00% |

| FairMoney | 1000 to 60k | 12.00% |

| L&T Finance | 50k to 25 lakhs | 11.00% |

| Upwards | Up to 5 lakhs | 16.00% |

| LazyPay | 3k to 5 lakhs | 12.00% |

| CreditScore, CreditCard, Loans | Up to 5 lakhs | 10.99% |

| Fast Cash Loan | 5k to 5 lakhs | 14.00% |

| Loanfront | 1,500 to 2 lakhs | 15.95% |

| Fedfina loans | 3k to 5 crores | 11.88% |

| Fullerton India mConnect | 10k to 30 lakhs | 8.00% |

| Groww | Pre-Approved Loan | 12.00% |

| Loan Planet | 5k to 5 lakhs | 18.25% |

Top 10 RBI Approved Loan Apps in India 2023

| Sr. No. | App Name | Credit limit |

| 1 | Kreditbee: Fast Personal Loan | 1,000 to 3 lakhs |

| 2 | Navi Loans & Mutual Funds | Loan up to 20 lakhs |

| 3 | CASHe Personal Loan App | 1,000 to 4 lakhs |

| 4 | PaySense: Personal Loan App | 5,000 to 5 lakhs |

| 5 | Fibe Instant Personal Loan App | Instant loans up to 5 lakhs |

| 6 | MoneyTap – Credit Lines & Loan | 3,000 to 5 lakhs |

| 7 | Money View: Personal Lona App | 5,000 to 5 lakhs |

| 8 | IIFL Personal Loan | 5,000 to 5 lakhs |

| 9 | Bajaj Finserv: UPI, Pay, Loans | Loans up to 25 lakhs |

| 10 | Home Credit – Loan App | 5,000 to 5 lakhs |

Features of RBI Approved Loan Apps in India

Before you take a loan to meet your financial needs, you need to know about the features of NBFC apps as RBI-registered loan apps have several features that you must be aware of to take advantage.

Transparency: RBI-approved loan apps follow strict guidelines set by the Reserve Bank of India, including disclosing loan terms and interest rates to borrowers.

Loan calculator: The EMI calculator helps estimate monthly loan payments, total interest paid, and other important information.

Online loan application: Allows users to apply for a loan directly through the app, providing a convenient and streamlined process.

Personalized loan recommendations: Based on credit score, income, and other factors, the app can recommend loans and lenders best suited to a user’s financial situation.

Educational resources: Provides information and resources to help users understand the loan process and make informed loan decisions.

Reminders for loan repayment: Allows users to set reminders for repayment of loans to avoid late fees or penalties.

Secure and encrypted: The app should be secure and encrypted to protect the user’s personal and financial information.

RBI Approved Loan Apps Interest Rate

The loan interest rate offered by lenders to an individual is determined based on several factors. These include credit score, debt-to-income ratio, income, and age. Users can enter their information. The app will give an estimate of the loan amount. It will also give the interest rate and tenure based on the applicant’s eligibility. The interest rates offered by NBFC apps range from 10% to 42% per annum.

Factors Affecting Loan Interest Rates

Credit Score: CIBIL is a three-digit rank code. It is given by the company to applicants. The rank is based on the loans and credit card repayments already taken by them. If you pay all your bills on time, your credit score will be good. You will have to pay a lower interest rate on loans. A score above 750 is considered a good credit score.

Geographical Location: If the applicant lives in a rural area, the loan interest rate is higher than in urban areas.

Applicant age: The age of applicants can also affect the interest rate offered by lenders. Individuals approaching retirement have lower earning potential. Individuals with less work experience need proof of financial stability. Individuals who have just started their careers also need proof of credit history. Such individuals are charged higher interest.

RBI Approved Loan Apps Eligibility Criteria

The eligibility criteria for a loan on the RBI Registered Loan Apps vary depending on the app and the lender.

- Credit score: A good credit score is usually needed to qualify for a loan.

- Income: Lenders will want to see proof of your income. Examples include pay stubs or tax returns. This is to confirm you can repay the loan.

- Employment status: Lenders need that you have a stable source of income. You must be employed or have a steady income stream.

- Debt-to-income ratio: Lenders will consider how much debt you already have about your income. They use this information to decide how much more debt you can handle.

- Residence: Some lenders need you to have a permanent location and be a resident of a specific state or country

- Age: Some lenders need you to be at least 18 years old to apply for a loan.

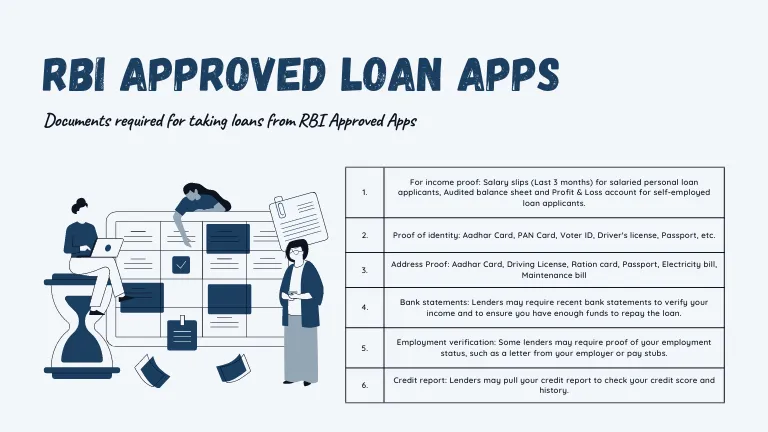

Documents required for taking loans from RBI Approved Apps

- For income proof: Salary slips (Last 3 months) for salaried personal loan applicants. Audited balance sheet and Profit & Loss account for self-employed loan applicants.

- Proof of identity: Aadhar Card, PAN Card, Voter ID, Driver’s license, Passport, etc.

- Location Proof: Aadhar Card, Driving License, Ration card, Passport, Electricity bill, Maintenance bill

- Bank statements: Lenders need recent bank statements to verify your income. They also need to guarantee you have enough funds to repay the loan.

- Employment verification: Some lenders need proof of your employment status, like a letter from your employer or pay stubs.

- Credit report: Lenders pull your credit report to check your credit score and history.

Please note that these are general guidelines. The specific criteria for loan eligibility vary depending on the app and lender you are using.

How to apply for a loan on RBI Approved Loan Apps in India?

To apply for a loan on the RBI Approved Apps, you will need to follow these steps:

- Download the app from the App Store or Google Play Store and create an account.

- Fill out the loan application form with your personal and financial information, like your income, employment status, and credit score.

- Apply and wait for the app to match you with one or more lenders.

- Review the loan offers and select the one that best meets your needs.

- Sign the loan agreement and send any required documentation.

- Wait for the lender to process your application and disburse the loan funds to your account.

Please note that the process varies depending on the app you’re using and your specific circumstances.

RBI Approved Loan Apps Related FAQ:

Which loan apps are RBI-approved?

The Reserve Bank of India (RBI) approves and regulates various loan apps in India. Some of the most popular RBI approved loan apps that are approved by the RBI, like Bajaj Finserv, Tata Capital, CASHe, Fibe, Faircent, FlexiLoans, Fullerton India, IndiaLends, Lendingkart, etc.

Are online loan apps safe?

Online loan apps can be safe as long as they are approved by the Reserve Bank of India (RBI) and follow the rules set by RBI. It is necessary to be careful and take steps to protect yourself when using online loan apps.

3 thoughts on “RBI Approved loan apps in India List, Read Now”